Free Tax Preparation

The Brown County Public Library will once again be providing FREE basic state and federal tax preparation to qualified Brown County residents. With the help of our volunteer trained Certified Tax Preparers and United Way of South Central Indiana, your library is here to help you complete and file your taxes.

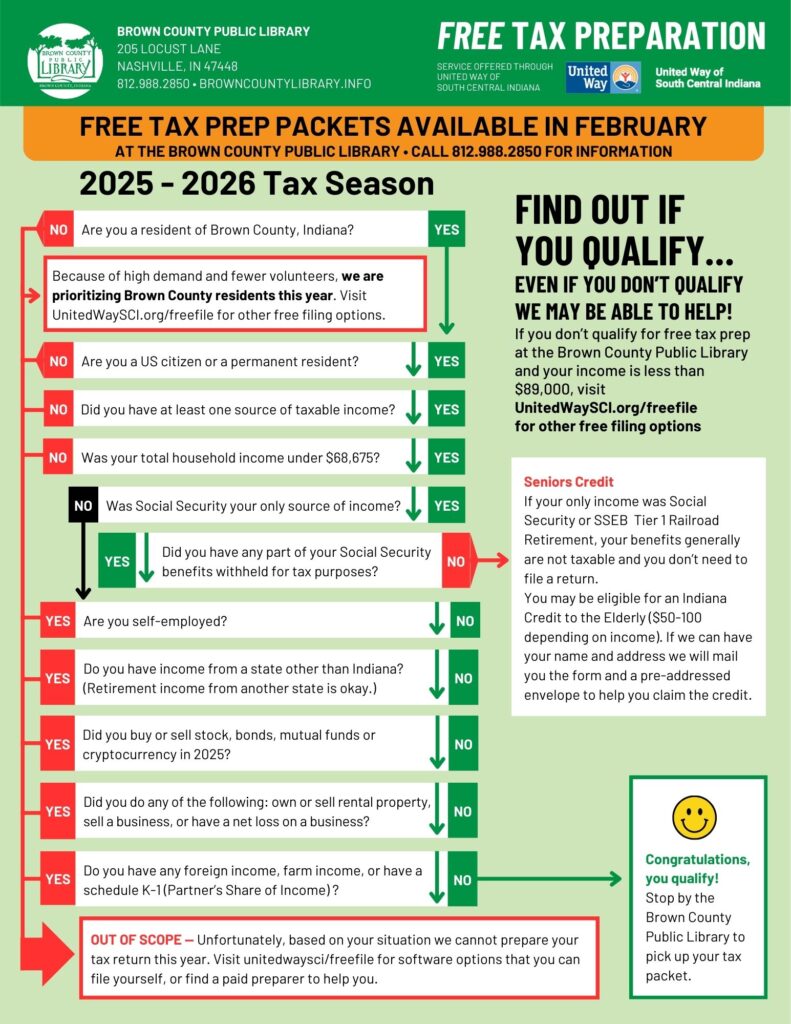

Read the flowchart below, complete the online Eligibility Form, or call the Brown County Public Library at 812.988.2850 to see if you qualify. (NOTE: Even if you complete the online form, you will be required to go through the qualification steps again when you visit the Library.)

Free Tax Prep Packets will be available at the Library beginning January 26, 2026

Completed packets must be returned to the Library no later than March 31, 2026

To participate:

- Call or stop by the Brown County Public Library to see if you qualify.

- NEW for 2026 — Participation is limited to residents of Brown County, Indiana.

- Complete and return your packet to the Library by March 31, 2026.

- A volunteer Certified Tax Preparer will complete your tax forms and schedule an in-person appointment. You must provide a valid phone number where the Preparer can leave a voicemail or send a text message if you cannot be reached.

- Approve and sign your tax returns at your in-person meeting

Are you eligible?

The Free Community Tax Service can help residents who made less than $68,675 in 2025 file their federal and Indiana tax returns for FREE and claim the Earned Income Tax Credit (EITC), if eligible. To see if you qualify, follow the chart below or use the online Eligibility Form. If you don’t qualify, don’t worry! People making less than $89,000 can also find free online filing options by using the IRS Free File Online Lookup Tool.

Be Prepared!

You will need to submit the following items to receive free tax preparation:

- All W-2s, W-2Gs, 1099s and Social Security/Unemployment benefit statements related to income received during 2025.

- Form 1095-A, B, or C (Affordable Health Care Statements).

- Any other tax forms received.

Additional information that may be required:

- If claiming child and dependent care expenses: the name, address, and social security number or EIN (employer identification number) of the provider.

- If a homeowner, a copy of your county real estate tax statement.

- If claiming the Indiana Renter’s Deduction: the name, address, and phone number of the landlord.

- Copies of last year’s federal/state tax returns.

- All 1098s related to interest on student loans, including 1098-T.

- Out-of-pocket educational expenses for college.

- Any donations to Indiana colleges.

- For direct deposit of your refund, you must provide bank account and routing numbers.

You will need to bring the following to your in-person meeting:

- Valid picture identification for taxpayer and spouse.

- Social Security cards and birth dates for yourself, spouse, and dependents.

- If filing jointly, both spouses must be present to sign the required forms.

- Download the Appointment Checklist

Additional Resources

- Information on the Earned Income Tax Credit (EITC)

- IRS Free File

- United Way of South Central Indiana

- United Way of South Central Indiana en Español

- Indiana Department of Revenue Free Filing

- Indiana Tax Forms

- IRS Forms and Instructions